We Create Impactful Connections for You

Institutional and HNW Investors Receive Priority Access to CEOs, 1-on-1s, Proprietary Research, and Presentations with transcripts.

March 25–26, 2026

Q1 2026 Presenters

March 25, 2026 - 9:00 AM - 5:00 PM EST

Connecting Microcap Companies with Leading Investors

Why We Are Better

GATED AND VETTED

0 deal guys and 0 service providers

INTENT

At vendor events, meetings are often favors. Meetings with us are a result of true intent to buy on the open market.

ACTUAL RESULTS

Truly qualified meetings per company

presentation views + thousands of newsletter impressions post event

CONCIERGE SERVICE

The experience is a light lift for the presenting companies. Our investors show up and come prepared.

Quality Research

Complimentary Equity Research distributed to Instutional investors

WE ARE INDEPENDENT

We only focus on providing companies with high quality service and do not sell anything else after the event.

Virtual Event Format

Who Participates

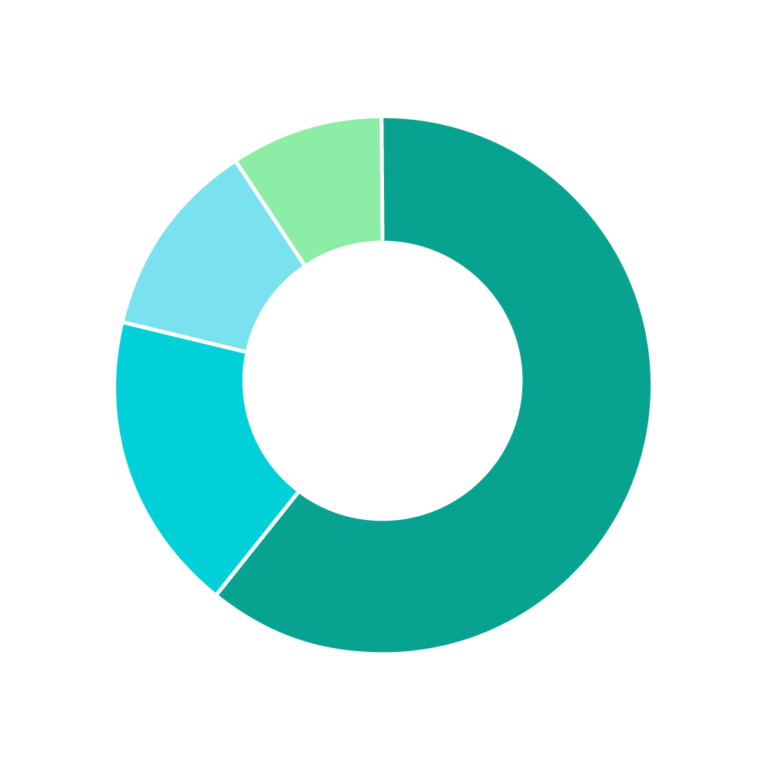

Market Cap

$0 – $50M (37%)

$50 – $100M (41%)

$100 – $300 (13%)

$300+ (9%)

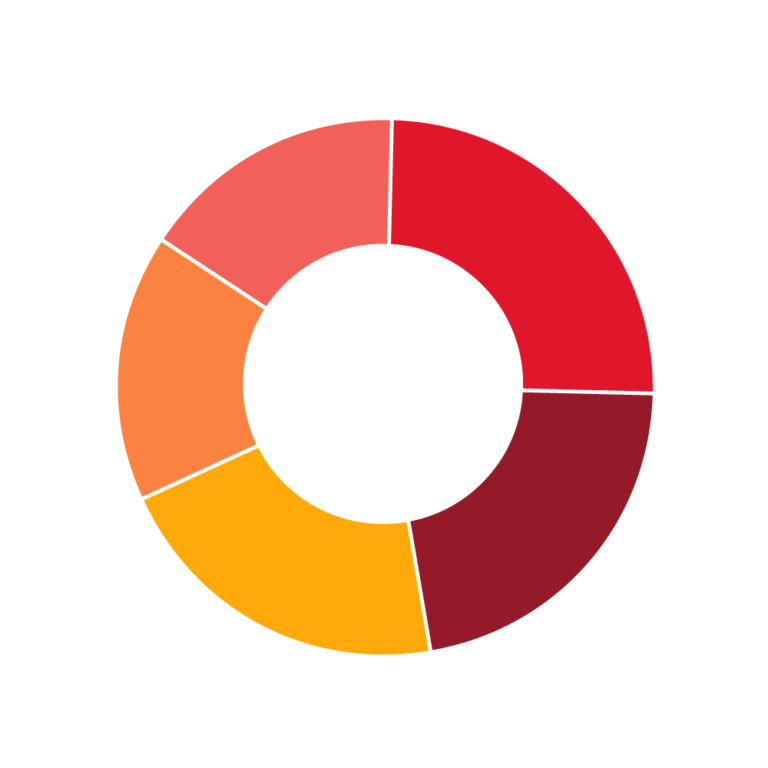

Sector

Healthcare (25%)

Consumer/Financial (23%)

Technology (22%)

Energy/Cannabis (16%)

Industrial/Blockchain (14%)

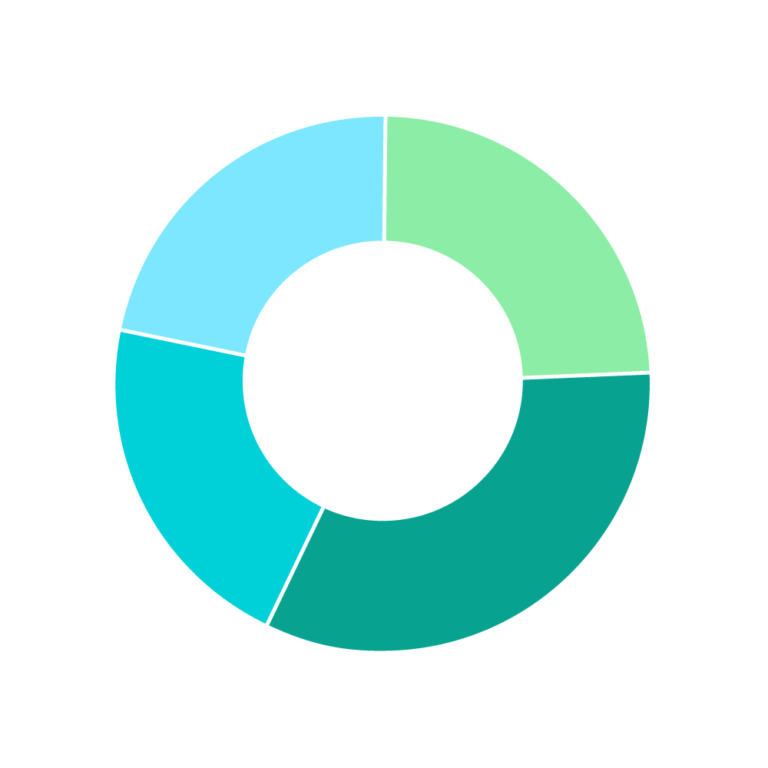

Investor Breakdown

Family Office (12%)

Institutional (61%)

HNW (9%)

RIAs (18%)

What Investors and Presenting companies say about

Investor Summit Group

We participated in the virtual Summer Summit with a micro-cap client of ours, VIQ Solutions, Inc. We were very pleased to see that we had a full book of meetings for 3 of the four days of the event. The meetings were high quality and we've since had several follow-up meetings. We would definitely recommend the Summit for any micro or nano-cap company that's looking for HNW, accredited retail and family office investors.

Fred Rockwell and his team at Investor Summit Group put on world class investor events. The Investor Summit conferences are typically well-attended, thoughtfully organized, and provide a valuable opportunity to meet with many high quality management teams in a short amount of time. Looking forward to future conferences.

When JetPay first began our IR outreach, the MicroCap Conference (now the Investor Summit) was one of the first at which we participated. It is the only one we continued to attend each year, because of the quality of investor audience, presentation attendance, and overall setup. There is no question in our mind that this helped JetPay maintain our stock price and NASDAQ listing, allowing us to sell JetPay to NCR at a 168% premium to our share price at closing. We would recommend this conference to any small-cap company in our vertical markets.

We truly enjoyed the event and met with a

number of high-quality investors that we

intend to continue dialogue with. We look

forward to participating in future events

that you host. Thanks for putting on such a

high-quality conference, we’ll be sure to let

industry colleagues know of how valuable our

opportunity was.

As always, the Investor Summit is very

well-run and scheduled, with a wide variety of

attendees. We feel we receive great value for the

investment in the conference with the exposure

we receive to new and existing investors.

While many investor conferences have transitioned to virtual format in recent weeks, The Investor Summit was far more of a success than others. I had a full slate of 1X1s, a well-attended presentation and no issues with the conferencing lines or other virtual aspects of the conference. I’m looking forward to the next Investor Summit conference.

Sponsors